ETH Price Prediction: Analyzing Short-term Targets and Long-term Projections Through 2040

#ETH

- Technical Strength: ETH trading above key moving averages with bullish MACD momentum suggests continued upward potential

- Institutional Demand: Significant whale accumulation and ETF inflows creating substantial buying pressure and reducing circulating supply

- Ecosystem Development: Layer 2 scaling solutions and growing DeFi adoption supporting long-term utility and value appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

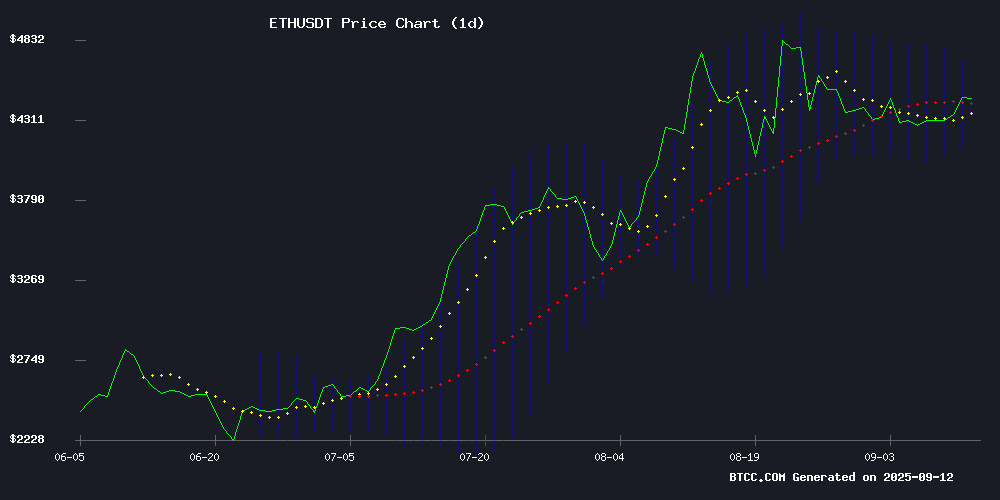

ETH is currently trading at $4,633.56, positioned above its 20-day moving average of $4,411.73, indicating sustained bullish momentum. The MACD reading of 120.76 versus its signal line at 105.80 shows positive momentum with a histogram value of 14.97. Price action is approaching the upper Bollinger Band at $4,674.53, suggesting potential resistance ahead while maintaining a strong technical structure above the middle band.

According to BTCC financial analyst Olivia: 'The technical configuration supports continued upward movement, with the price holding comfortably above key support levels. The MACD bullish crossover and position NEAR the upper Bollinger Band indicate strong buying pressure in the market.'

Market Sentiment: Institutional Accumulation and ETF Demand Drive Optimism

Recent market developments show significant institutional interest with three whales acquiring $205 million worth of ethereum through FalconX, alongside BitMine expanding holdings to over 2.1 million ETH with a $200 million purchase. ETF demand acceleration is driving institutional inflows, while analysts project potential targets reaching $5,100-$6,000 based on Elliott Wave Theory patterns.

BTCC financial analyst Olivia notes: 'The combination of substantial whale accumulation, expanding institutional adoption through ETFs, and positive technical patterns creates a fundamentally supportive environment for Ethereum. While short-term volatility persists due to gas fee concerns and market fluctuations, the underlying institutional demand provides strong foundation for continued growth.'

Factors Influencing ETH's Price

Three Whales Acquire $205M Ethereum via FalconX Amid Market Volatility

Ethereum's price action remains range-bound as market uncertainty persists, yet institutional demand for the asset continues to escalate. Three newly identified whale wallets purchased over $200 million worth of ETH in a single day, signaling strong accumulation despite choppy conditions.

Exchange supply dynamics reveal a strategic shift: ethereum is increasingly moving into cold storage, reducing sell-side pressure. Arkham's data underscores this trend, highlighting a growing divergence between short-term volatility and long-term institutional conviction.

The market's quiet accumulation phase suggests whales are positioning for Ethereum's next major move. FalconX facilitated the nine-figure transaction, demonstrating how institutional gateways enable large-scale crypto flows even during periods of price indecision.

Ethereum’s Future: Can it Maintain Dominance Over Layer 2s?

Ethereum has long been the backbone of decentralized finance and Web3, serving as the premier platform for building decentralized applications due to its robust smart contract architecture. Yet, the landscape is shifting. The rise of Layer-2 solutions like Arbitrum, Optimism, and Base—designed to slash transaction costs and boost throughput—poses a new challenge. These networks now handle a significant share of Ethereum’s activity, complete with their own tokens and ecosystems.

The crypto sector’s expansion opens fresh opportunities for investors, but questions loom. Can Ethereum retain its dominance in a market increasingly focused on scalability and user experience? Meanwhile, new presale tokens like MAGACOIN FINANCE vie for attention, adding another layer of complexity to the investment landscape.

Layer-2 adoption has surged over the past two years, with networks like Arbitrum and Optimism seeing dramatic increases in daily active users and total value locked (TVL). Ethereum’s mainnet increasingly functions as a settlement layer rather than an execution environment, underscoring its unmatched security and decentralization. But this shift raises critical questions about value capture—if most activity migrates to Layer 2s, where does Ethereum’s intrinsic value lie?

Ethereum's Rally Eyes $6,000 as Elliott Wave Theory Signals Extended Fifth Wave

Ethereum's march toward $6,000 appears poised for another leg higher, with Elliott Wave analysis suggesting a subdivided fifth wave could propel prices beyond initial targets. The cryptocurrency recently completed a textbook wave sequence, peaking at $4,955 after forecasting each move with precision—from the $4,792 Wave-iii top to the $4,067 Wave-iv correction.

Market technicians now focus on the potential for an extended fifth wave, a common phenomenon in crypto markets. The September 1 low of $4,212 likely marked Wave-2 of this final push, with Wave-3 currently targeting $5,655 or higher. This technical setup reinforces Ethereum's bullish momentum while demonstrating Elliott Wave's continued relevance for crypto traders navigating volatile markets.

Ethereum vs. Ozak AI: Divergent Paths in Crypto Investment Strategies

Ethereum maintains its dominance as the cornerstone of decentralized finance and Web3 infrastructure, trading steadily NEAR $4,430. Analysts project a gradual climb toward $10,000, with immediate resistance at $4,500 and robust support at $4,300. The network's entrenched position offers stability, but its growth trajectory lacks the volatility of emerging tokens.

Ozak AI enters the presale market at $0.01, touting 100x potential—a stark contrast to Ethereum's measured ascent. While ETH appeals to institutional investors with its liquidity and proven use cases, OZAK targets speculative capital chasing exponential returns. The dichotomy reflects a broader market tension between blue-chip assets and high-risk altcoins.

BlackRock ETH Sell Before Expiry, But Bulls Target Ethereum Rally

BlackRock's surprise sale of $45.1 million in Ethereum (ETH) just hours before a $4.21 billion options expiry has sent ripples through the crypto market. The MOVE raises questions about institutional positioning ahead of critical derivatives settlements.

Despite the sell-off, Ethereum bulls remain optimistic about a potential rally. Market participants are closely watching whether this was a tactical exit or part of a broader risk management strategy by the asset management giant.

Ethereum Breakout Confirmation Attracts Two Key Groups — Is the Price Heading to $5,100?

Ethereum's falling wedge breakout gains momentum, with on-chain and derivatives data signaling strong backing from two critical market cohorts. Spot holders are withholding supply while derivatives traders ramp up activity—a combination that could propel ETH toward $5,110 if current conditions persist.

The Spent Coins Age Band metric reveals a 64.5% drop in ETH movement across all age groups since September 4, contrasting sharply with previous rallies where long-held coins flooded the market. This supply squeeze coincides with surging derivatives demand, creating a potent bullish setup absent the sell-pressure that capped earlier summer rallies.

Gas Fees and Blockchain: A Closer Look at Ethereum

Gas fees, a critical component of blockchain transactions, are most commonly associated with the Ethereum network. These fees compensate for the computational energy required to process and validate transactions on the blockchain.

Ari Wallet, a newly launched blockchain application, has gained unexpected popularity since its debut on January 7. The wallet's rapid adoption highlights growing interest in user-friendly crypto tools, though its connection to Ethereum's gas fee structure remains indirect.

BitMine Expands Ethereum Holdings to Over 2.1 Million ETH with $200M Purchase

BitMine Immersion Technologies (BMNR) has significantly bolstered its Ethereum reserves, acquiring an additional 46,225 ETH worth approximately $200 million. This latest purchase elevates the firm's total holdings to over 2.1 million ETH, valued at $9.27 billion at current market prices.

The New York Stock Exchange-listed entity now commands the largest Ethereum treasury among public companies, far surpassing competitors like SharpLink, which holds 837,230 ETH. BitMine's aggressive accumulation strategy, including a 202,500 ETH purchase in September, underscores its ambition to control 5% of ETH's total supply.

Other notable corporate holders include Coinbase (136,782 ETH) and Bit Digital (120,306 ETH), though none rival BitMine's dominance. The firm's sustained buying spree signals deepening institutional conviction in Ethereum's long-term value proposition.

Ethereum Price Volatility Spurs Shift to Cloud Mining Amid Bearish Sentiment

Ethereum's price has oscillated between $4,200 and $4,500 for two weeks, with weakening institutional demand fueling bearish projections of a drop to $3,500. Traders cite subdued spot activity and macroeconomic uncertainty as key catalysts for the stagnation.

Cloud mining platforms are gaining traction as an alternative revenue stream amid ETH's volatility. Fleet Mining dominates the 2025 landscape with AI-optimized contracts and transparent fee structures, offering $15 sign-up bonuses and daily payouts. Short-term plans like the $100 Starter Miner promise 6% returns in 48 hours.

The migration from individual mining accelerates as hardware costs and regulatory hurdles RENDER traditional operations impractical. Cloud services eliminate capital expenditures but require rigorous due diligence—returns vary dramatically across providers despite standardized marketing claims.

Christie’s Exits NFT Market as Digital Art Trading Volumes Plummet

Christie’s has shuttered its digital art division amid a prolonged downturn in the NFT market. The auction house dismissed two executives, including digital art VP Nicole Sales Giles, who spearheaded its NFT strategy. Her departure follows a 45% quarterly decline in NFT trading volume to $867 million, per DappRadar data.

Blue-chip NFT collections now trade at fractions of their peak values. CryptoPunks hover near 46.6 ETH ($210,000), while Bored Ape Yacht Club NFTs changed hands at just 9.1 ETH ($41,000). The retreat comes despite ethereum’s 76% rally this quarter, underscoring NFTs’ divergence from broader crypto market gains.

Market observers suggest the move reflects pragmatic restructuring rather than outright abandonment. NFTs may increasingly be integrated into traditional art sales rather than treated as a standalone asset class.

Ethereum Institutional Inflows Surge as ETF Demand Accelerates

Ethereum is reclaiming market attention as U.S. spot ETF products witness accelerating institutional capital flows. BlackRock's Ethereum ETF recorded a $74.5 million single-day inflow on September 11, 2025, while Fidelity's product attracted $49.5 million, according to Farside Investors data. Weekly net inflows across all U.S. Ethereum ETFs have surpassed $171 million, signaling strong institutional conviction despite regulatory hesitations around staking mechanisms.

The asset currently trades near $4,400, testing critical technical levels. Market technicians identify $4,500 as the decisive resistance breach that could catalyze fresh momentum, with $4,250 serving as crucial support. Ethereum's $529 billion market capitalization reflects its entrenched position as the foundational LAYER for DeFi, NFT markets, and emerging blockchain-AI integrations.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market fundamentals, Ethereum demonstrates strong potential for both near-term appreciation and long-term growth. The current price of $4,633.56, combined with institutional accumulation patterns and ETF adoption trends, suggests a positive trajectory.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200-$5,800 | $6,000-$6,500 | $7,000+ | ETF adoption, institutional inflows |

| 2030 | $8,000-$12,000 | $15,000-$20,000 | $25,000+ | Layer 2 scaling, DeFi maturation |

| 2035 | $18,000-$25,000 | $30,000-$40,000 | $50,000+ | Enterprise adoption, Web3 infrastructure |

| 2040 | $35,000-$50,000 | $60,000-$80,000 | $100,000+ | Global digital economy integration |

BTCC financial analyst Olivia emphasizes: 'These projections consider Ethereum's evolving utility, network upgrades, and growing institutional adoption. While short-term volatility is expected, the fundamental drivers including ETF demand, Layer 2 ecosystem growth, and increasing institutional allocation provide strong support for long-term appreciation potential.'